Reversal Signals are the on-chart candlestick indicator signaling turning point of downtrend will make move to uptrend and the vice-versa. The main importance of understanding reversal signals pattern is to make a final decision on whether 'to Buy' or whether 'to Sell'.

This is my compilation from reading various articles on forex subject and they worked for me, taking profit during my trading course on my real account.

This is my compilation from reading various articles on forex subject and they worked for me, taking profit during my trading course on my real account.

The seven (7) reversal signals

1.) Doji2.) Harami

3.) Engulfing Bullish/Bearish

4.) Tweezer/Marubozu

5.) Morning Star

6.) Evening Star

7.) Hammer and Hanging man

Pictorial Learning

1.) Doji

There are five (5) types of Doji;

|

| Doji Pattern I |

|

| Doji Pattern II |

|

| Doji Pattern III |

|

| Dragon Fly Doji |

|

| Graveyard Stone Doji |

Any formation of Doji candlesticks, it does not mean that a final decision has to be made at that time (on the spot), but, must wait for next sideway candlestick formed whether bullish or bearish. Once bullish, make an entry for 'Buy' and once bearish, make an entry for 'Sell'.

2.) Harami

Both candlesticks forming a unique shape that looks like a pregnant woman.

If the sideway formed bearish, make an entry for 'Sell'. If the sideway formed bullish, make an entry for 'Buy'.

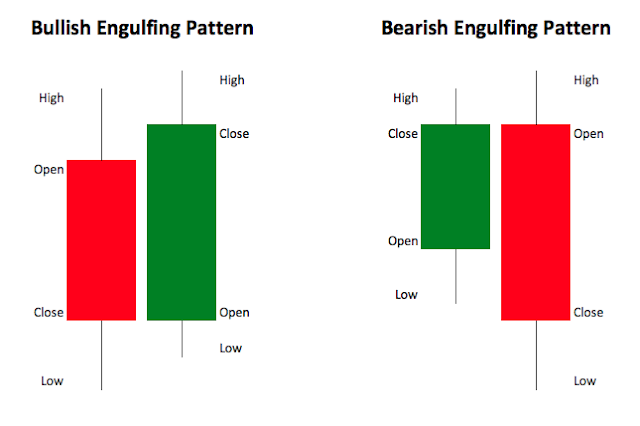

3.) Engulfing Bullish/Bearish

So, the sideway confirmation candlestick formation influences the decision making for; If the sideway formed bearish, make an entry for 'Sell'. If the sideway formed bullish, make an entry for 'Buy'.

|

| Image Credit to Trader Rach |

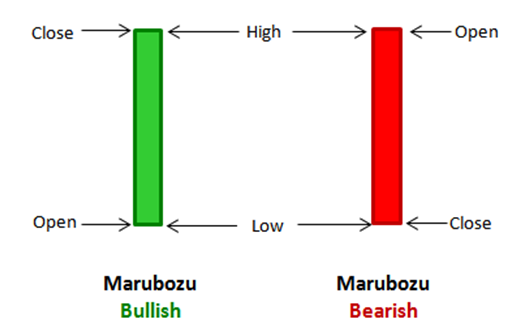

4.) Tweezer/Marubozu

So, Marubozu signifying for what?

5.) Morning Star

Morning star candlestick normally formed during turning point from downtrend to uptrend. At this point, a trader must get ready to making an entry for 'Buy'.

6.) Evening Star

Evening star candlestick normally formed during turning point from uptrend to downtrend. At this point, a trader must get ready to making an entry for 'Sell'.

|

| Image Credit to EA-Coder |

So, Marubozu signifying for what?

|

| Image Credit to EA-Coder |

5.) Morning Star

Morning star candlestick normally formed during turning point from downtrend to uptrend. At this point, a trader must get ready to making an entry for 'Buy'.

|

| Image Credit to the Online Trading Concept |

6.) Evening Star

Evening star candlestick normally formed during turning point from uptrend to downtrend. At this point, a trader must get ready to making an entry for 'Sell'.

|

| Image Credit to the Online Trading Concept |

7.) Hammer and Hanging man

Hammer signaling for bullish from downtrend and Hanging man signaling for bearish from uptrend. Once Hammer candlestick formed, a forex trader must get ready for 'Buy'. Once Hanging man candlestick formed, a forex trader must get ready for 'Sell'.

Sometimes, you'll see an inverted Hammer candlestick formed, which is, normally formed at the peak of uptrend. So, it signifies ready for 'Sell'

Hammer signaling for bullish from downtrend and Hanging man signaling for bearish from uptrend. Once Hammer candlestick formed, a forex trader must get ready for 'Buy'. Once Hanging man candlestick formed, a forex trader must get ready for 'Sell'.

Sometimes, you'll see an inverted Hammer candlestick formed, which is, normally formed at the peak of uptrend. So, it signifies ready for 'Sell'

|

| Image Credit to the Online Trading Concept |

No comments:

Post a Comment